Bill Bonner, reckoning today from Baltimore, Maryland...

It looks like the post-Thanksgiving shopping binge was not nearly as successful as hoped. Here’s The Wall Street Journal:

Sales at bricks-and-mortar stores over Thanksgiving weekend fell short of prepandemic levels and were behind last year’s totals, another sign that Black Friday is losing its status as the crucial kickoff to the holiday-shopping season.

“It used to be people would wait in line from midnight for the stores to open at 4 or 5 a.m….”

What happened?

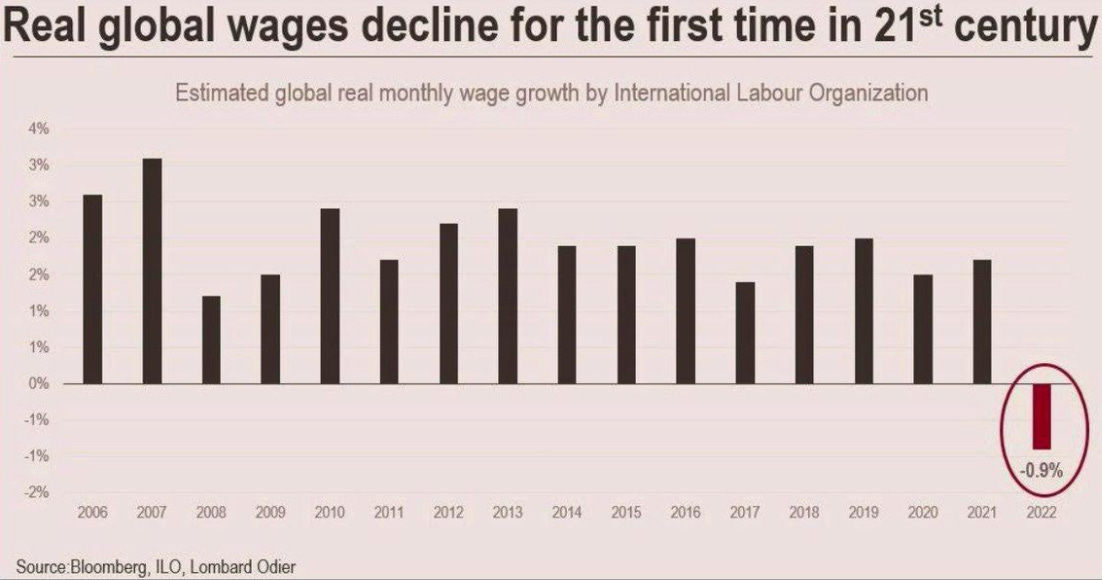

Hot off the press is a report from the UN’s International Labor Organization. It tells us that for the first time this century, workers of the world are getting poorer:

This year’s ILO Global Wage Report… shows that, for the first time this century, global real wage growth has become negative while real productivity has continued to grow. Indeed, 2022 shows the largest gap recorded since 1999 between real labour productivity growth and real wage growth in high income countries. While the erosion of real wages affects all wage earners, it is having a greater impact on low-income households which spend a higher proportion of their disposable incomes on essential goods and services, the prices of which are increasing faster than those for non-essential items in most countries.

Blood on Main Street

One of the themes we’ve been following is the “middle class massacre.” Yes, everyone knows that the middle class gets scalped in an inflationary period. It spends most of its money on consumer items; as prices go up, it loses purchasing power.

Inflation also destroys the value of its time. The middle class sells its time to earn a living. Typically, as inflation rates go up, real wages go down. Countries with high inflation rates – Argentina, Venezuela, Turkey – are usually poor, with a middle class that is getting poorer. Countries with low inflation rates, on the other hand – such as Switzerland – have prosperous middle classes.

Back in the summer, we reported the US was suffering the biggest wage losses in 20 years – with working class incomes down 2.8% (annually) between March and May of this year. To get that number, you had to subtract the CPI (inflation) from the nominal wage increases.

Simple math was apparently too much for most reporters. As of last week, they were declaring that wage-earners were seeing ‘strong gains’ of 5.1%. This was nonsense. But you had to subtract today’s 7.7% inflation rate to see what was really going on. Then, it was clear that the labor market was weak, not strong. The working stiffs were actually still losing ground, at the rate of about 260 basis points (2.6%) per year. In October, for the 20th month in a row, the middle class got poorer.

Tapped Out

And now, while middle class shoppers run out of money, the whole economy runs out of fuel. CNBC:

Americans are spending 10% more than they did a year ago due to inflation and rising interest rates, [JP Morgan CEO, Jamie] Dimon said, and they’re tapping into their savings to do so.

The personal savings rate—which measures consumers’ savings as a percentage of their disposable income—fell to just 2.3% in October, well below the over 9% figure seen before the pandemic.

“Inflation is eroding everything,” Dimon told CNBC. “[T]hat trillion and a half dollars will run out sometime mid-year next year.

Whom does recession affect most severely? The middle class of course. They lose jobs and incomes…while the value of their main capital assets – their homes – falls. Stagflation, too, is deadly to the middle class. They lose income – while their costs of living keep going up.

But if inflation/recession/stagflation are harmful to lumpen consumers, few dare to wonder why they are so common? After all, the middle class is where “the people” are. And if the feds wanted to do what was best for the majority of the nation, they would stop inflation immediately.

But inflation continues.

There is no mystery to controlling inflation. You just have to stop spending money you don’t have…stop lending out money at interest rates below inflation…and stop ‘printing’ up extra money to cover the holes in your budget.

Instead, most governments continue to spend and print. Inflation is on the rise almost everywhere. And for the first time in modern history, much of the entire world’s middle class – the people who make the world work – is facing a grim period of higher inflation and lower real standards of living.

What’s really behind it?

Stay tuned...

Bill Bonner

Joel’s Note: “One. Two. Three strikes you’re out!”

Bonner Private Research’s macro analyst, Dan Denning, has been on the case as usual. The UN report to which Bill referred above shows a 3.2% wage decline in North America, “the largest of any region,” says Dan.

A couple of relevant charts, straight from the report. First, real (inflation adjusted) global wages:

And second, the same for North America:

Notice, too, that the declines in real wages this year have handily outpaced the same measure during the 2008 global financial crisis.

What’s driving this trend, you ask? Debt... deficits... and the dollar...

“The bottom line,” says Dan, “is that the advanced economies increased gross debt-to-gdp levels because they increased spending and income support to compensate for the lockdowns.”

“This had three effects,” he continues, “An increase in gross debt-to-gdp levels, higher inflation, and negative real wage growth.”

Hence the three strikes for baseball lovin’, middle class Americans...

By the way, this is exactly the kind of analysis Dan shares with BPR members in his Friday research notes. That is, deep dives into the macro data that helps Bill and the team “connect the dots” from the macro picture... all the way down to specific, actionable investment strategies aimed at helping you protect your wealth from the ravages of inflation, negative wage growth and other state-sponsored attacks on the middle class.

If you’re not already receiving Dan’s work, find a subscription plan that works for you below and join our private network today.

Of course, down here at the “fin del mundo,” Argentina’s annual inflation rate just topped 88%... so don’t go expecting any sympathy from the porteños. The Argies just nudged out Turkey (which came in at a nevertheless unrespectable 85.5%) for the top spot among G20 nations.

The government here, always at the bleeding edge of economic lunacy, responded the only way they know how: by freezing prices on 1,700 products... products we expect will soon be in short supply. Ho-hum…

The quoting of inflation rates and wage gains is missing the true impact. Inflated prices for the middle class have to be paid with after tax dollars while wage gains don't reflect the actual take home monies after deductions. It makes the shrink in disposable income much larger than those simple numbers

From experience I would say inflation is at least 20%. Price at grocery store is up closer 60% and I don't eat high on the hog. If it costs too much, don't buy it. Try to save money every day. It won't last forever, but this is a long term swipe at the middle class. Not just to defeat, but to destroy. Heartless, selfish , greedy bastards all. Gold, it is the only lasting hope outside of planting the food you eat and growing what you need to survive. They are going for the jugular this time. Invest wisely and there are ways to grow your wealth. There are good, well run companies that will make you money. Maybe not rich, but turn a profit. I can see the highways overcrowded with stalled electric vehicles. Knowing Americans, this won't last till the water gets hot. Buy a bicycle, it may be the only thing you can depend on. Just sayin'

Don Harrell